Retail Media Radar - October 2025: New Entrants, New Standards

October’s developments signal a step change for retail media. American Express has officially entered the commerce media race with the launch of AmexAds - a move that blurs the line between retail media, financial services, and closed-loop data. Meanwhile, IAB Europe has certified its first retailer, Albert Heijn, under a new retail media certification programme - laying the groundwork for greater trust, transparency, and interoperability across the ecosystem.

Alongside these shifts, Criteo’s partnership with DoorDash continues to push the boundaries of offsite retail media, while in-store environments are becoming an increasingly strategic differentiator in the battle for shopper attention. Together, these stories paint a picture of a sector moving beyond growth headlines towards infrastructure, standardisation, and category expansion.

1. Amex Launches AmexAds: Commerce Media Gets Financial Muscle

American Express has launched AmexAds, a self-serve advertising platform that allows brands to target and measure campaigns using Amex’s vast transactional data. This is more than just another media network - it’s a sign of commerce media expanding beyond traditional retail into adjacent industries with powerful closed-loop datasets.

Brands will be able to use AmexAds to target audiences based on anonymised purchase behaviour and lifestyle segments, reaching customers across Amex’s digital channels and external media environments.

Crucially, Amex can connect media exposure to real-world spend, offering advertisers deterministic attribution across categories like travel, luxury, dining, and retail.

Amex has a history of partnering with premium brands; AmexAds brings that commercial network into the media ecosystem, creating a new kind of high-affinity, high-spend audience marketplace.

With no physical shelves to monetise, Amex’s move underscores how commerce media is no longer the sole domain of retailers - financial services players, telcos, and mobility platforms are all circling.

Amex’s entry is a watershed moment. It shows that the retail media playbook is being picked up by companies with equally powerful data, audiences, and loyalty ecosystems - but without legacy store footprints. For retailers, this is both a wake-up call and an opportunity: partnerships and positioning will matter more than ever as commerce media expands horizontally.

Find out more here.

2. IAB Europe Certifies Albert Heijn: Standards Take Shape

In a milestone for the maturing retail media landscape, IAB Europe has certified Albert Heijn as the first retailer to meet its new Retail Media Certification Programme, audited by ABC.

The certification framework aims to bring clarity and consistency to retail media by setting common standards for metrics, transparency, and trading practices - much like IAB standards once did for digital display.

Albert Heijn underwent a rigorous audit covering campaign reporting, targeting capabilities, brand safety, and operational transparency.

As retail media investment scales, advertisers are demanding comparability across networks - a critical barrier to further budget shifts.

IAB’s involvement signals that retail media is moving from innovation to infrastructure, where industry bodies shape the rules of engagement.

This is a pivotal step towards making retail media a sustainable part of omnichannel media plans. Standardisation won’t just enable fairer comparisons between networks; it will also push laggards to mature their measurement and reporting. The real question now is - who will follow Albert Heijn’s lead, and how quickly?

Find out more here.

3. Criteo x DoorDash: A Bid to Own the Retail Media Buying Layer

Criteo has partnered with DoorDash to give advertisers programmatic access to DoorDash’s ad inventory, marking a significant step in its ambition to become the neutral buying layer for retail media. Rather than working with each retail network separately, brands can now plan and activate campaigns across multiple retailers - including DoorDash - through Criteo’s platform.

The partnership allows advertisers to tap into DoorDash’s valuable shopper data and on-platform ad inventory, but through a single, centralised Criteo interface.

It builds on Criteo’s wider strategy to aggregate retailer inventory, offering identity-resolved targeting and unified measurement for campaigns that span different networks.

For brands, this promises greater scale and efficiency - particularly in fast-growing offsite and last-mile channels like food delivery, where DoorDash brings high-frequency, intent-rich audiences.

For retailers, though, there’s a trade-off: plugging into Criteo gives them reach and incremental spend, but also means ceding some control over data, targeting and advertiser relationships to an intermediary.

This move positions Criteo as a kind of ‘independent DSP’ for retail media, with DoorDash giving it a compelling proof point in high-velocity convenience commerce. But the strategic question remains: who controls the buying layer? If Criteo becomes the default route for retail media budgets, retailers risk becoming data providers rather than media owners. The smart ones will engage tactically - leveraging Criteo’s scale without surrendering strategic control.

Find out more here.

4. In-Store Media Becomes a Strategic Differentiator

As competition intensifies, retailers are doubling down on in-store media - not just as an add-on to digital campaigns, but as a strategic differentiator in the fight against Amazon’s dominance. With the online giant still lacking a significant physical retail media footprint (Whole Foods aside), brick-and-mortar retailers are realising their stores offer something Amazon can’t: proximity, physical presence, and sensory engagement.

Retailers are increasingly using digital screens, dynamic audio, and contextual triggers to turn physical spaces into programmable media networks.

Carrefour is expanding its in-store digital signage to support audience-based targeting; Walmart is integrating Vizio screens and checkout touchpoints; and Tesco and Sainsbury’s are exploring hyperlocal campaigns tied to weather, daypart, or even specific shelf movements.

Some are experimenting with non-traditional formats - such as using smart trolleys, floor projections, or entrance portals - to build more immersive media moments that can’t be replicated online.

Partnerships with measurement providers are improving attribution, helping retailers prove the real-world impact of in-store activations on both immediate basket size and long-term loyalty.

While much of the industry narrative frames in-store media as a ‘catch-up’ play against Amazon, we see it differently. In-store isn’t just Amazon’s weak spot - it’s a fundamentally different playing field. Amazon’s scale is digital; retailers’ advantage is physical. But not every retailer will win by simply installing screens. The differentiator will be who can design in-store media experiences that complement, rather than mimic, digital tactics.

The future isn’t about making stores behave like websites; it’s about using physical retail to do what digital can’t - create context, trigger emotion, and influence decisions at the most human level. The winners will be those who treat their stores as cultural and experiential canvases, not just ad inventory.

Find out more here.

5. Bayer’s Retail Media Bet: From FMCG/CPG Advertiser to Data Power Player

Bayer has struck a strategic partnership with multiple retail media networks to gain deeper access to shopper data and offsite targeting capabilities, signalling a notable shift in how major FMCG/CPGs are approaching retail media. Rather than simply buying placements, Bayer is positioning itself to influence the ecosystem more directly.

The partnership spans several networks and is focused on unlocking richer, more granular data sets to fuel Bayer’s media activation and measurement - particularly offsite, where precision and attribution remain major pain points for many brands.

By investing in data integration rather than just inventory, Bayer is setting itself apart from CPGs who continue to treat retail media largely as a shopper marketing line item.

This move reflects growing CPG frustration with fragmented measurement and limited transparency across retail media’s walled gardens. Bayer’s play is an attempt to break through those walls, enabling more cohesive cross-network targeting and reporting.

It also hints at a future where the biggest advertisers don’t just participate in retail media - they help shape the rules, standards and data flows that underpin it.

Bayer’s strategy is significant: as retail media matures, the most sophisticated advertisers aren’t simply buying impressions, they’re buying influence. By embedding themselves deeper into the ecosystem, FMCG/CPG giants like Bayer could shift the balance of power - demanding interoperability, shared standards, and more meaningful performance accountability. For retailers, that means the days of ‘take it or leave it’ media packages are numbered.

Find out more here.

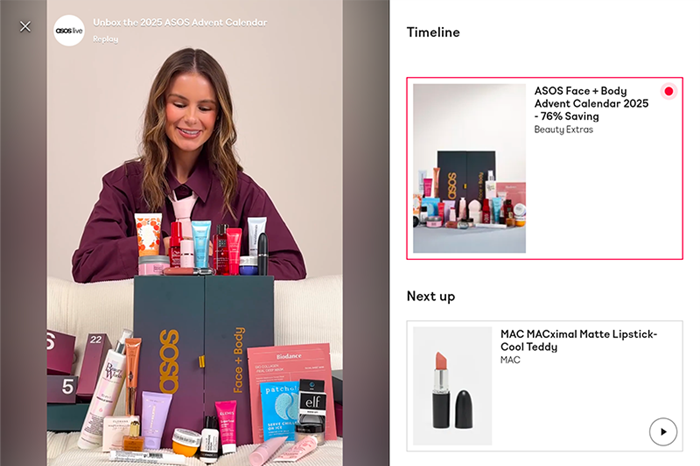

6. ASOS bets on video shopping – but the real play isn’t ‘live’

ASOS has launched Asos Live, a new video shopping experience that blends influencer content, real-time engagement, and in-video purchasing. The format positions ASOS closer to social commerce leaders in Asia than traditional UK retail models.

Shoppers can watch styling edits live or on demand, interact with creators, and purchase without leaving the video.

Since launch, 94% of views have happened on replay, not live.

ASOS is aiming to deepen customer engagement and drive inspiration-led purchasing through content, not just search or browse journeys.

The interesting part isn’t the tech – it’s the shift in where commercial value sits. Everyone’s been talking about ‘live shopping’ like it’s the next QVC. But ASOS’s replay numbers suggest something else: the real value is in producing high-quality, evergreen content that functions like a sales rep who never clocks off.

For most UK retailers, the instinct is to bolt this kind of experience onto the funnel as a marketing novelty. We’d argue the opposite. If treated seriously, this is a merchandising tool, not just a brand activation. It requires the same rigour as range curation or promotional planning – and could even influence pricing and assortment if tied into analytics properly.

Find out more here.

October’s developments signal a decisive shift in retail media’s trajectory. With Amex entering the arena, IAB Europe setting the first certification standards, and players like Google, Criteo and DoorDash reshaping partnerships, the conversation is moving beyond campaigns and placements toward infrastructure, governance and strategic reach. In-store media is also re-emerging as a competitive lever - not as a defensive play against Amazon, but as a high-value differentiator for retailers who can merge physical scale with digital intelligence. This isn’t just about who can sell media - it’s about who can set the rules, control the data flows, and define how commerce and media intersect. Those who move early to align commercial power, technological capability and trust will shape the next competitive landscape.