Retail Media Radar - November 2025: Creativity, Conversation and Convergence

Retail media is branching into places it’s never quite belonged - and thriving there.

Tesco is using AI to rewire the creative process itself, building campaigns that adapt as fast as shopper behaviour changes. Walmart’s partnership with OpenAI pushes shopping into conversational territory, where intent is expressed, interpreted, and fulfilled in real time. Amazon and Spotify’s new alignment hints at a future where competitors share infrastructure to protect ad budgets. And Marks & Spencer’s arrival on TikTok Shop brings a heritage brand into one of retail’s most unpredictable arenas - where culture, community, and commerce collide.

These moves show how the boundaries between retail, media, and technology are dissolving. The centre of gravity is shifting: creativity now sits inside data systems, platforms are learning to cooperate, and influence is being rewritten in public view.

1. Tesco’s Creative Studio: Where Retail Media Meets Generative Production

Tesco has unveiled Creative Studio - an AI-powered creative engine that builds, tests, and optimises campaign assets across every retail media format, from onsite display to in-store screens. The tool plugs directly into Tesco’s Sphere platform, uniting planning, activation, and measurement in a single environment.

Creative Studio uses generative AI to dynamically assemble copy, imagery, and layouts for different shopper types - current, lapsed, or prospective - while automatically enforcing brand and compliance rules.

It eliminates production bottlenecks by generating and adapting creative across multiple channels in real time.

Sphere’s integration connects creative production with targeting and performance data, allowing campaigns to continuously learn and refine.

In-store activations are now part of the same ecosystem through digital screens, checkouts and influencer content - merging creative and commerce experiences.

This is more than a workflow upgrade, it’s Tesco turning its retail media stack into a self-optimising creative system. Albertsons and Kroger have been testing similar models in the US, and Tesco’s move signals that UK retail media is ready for the same leap forward.

Tesco’s approach highlights how AI is moving from campaign optimisation to creative orchestration. The promise is scale and agility - creative that adapts automatically to audience signals without ballooning costs.

But the balance will be key. The more retailers automate creativity, the greater the risk of sameness. The winners will use AI not to replace creativity, but to enhance it, combining human insight with data-driven precision.

This as a defining step toward retail media networks becoming intelligent content systems, where every ad is smarter, faster, and more relevant, but still unmistakably on-brand.

Find out more here.

2. Amazon Ads × Spotify: When Retail Media Turns Audio Into Leverage

In a move few would’ve predicted, Spotify is giving Amazon Ads programmatic access to its audio and video inventory through Amazon’s DSP - meaning advertisers can now reach Spotify’s 696 million monthly users via the same platform used for Amazon’s ecommerce-driven media.

For Amazon, it’s a coup: Spotify’s ad inventory sits inside its DSP, effectively expanding Amazon’s media real estate far beyond its own properties.

For Spotify, it’s a paradox. The world’s biggest audio streamer has, in effect, handed a retail and data rival the keys to its premium audience, trading some competitive distance for access to Amazon’s advertiser demand.

The partnership positions Amazon’s DSP as a “meta-platform” - not just selling its own audiences, but aggregating those of its peers.

For brands, the allure is obvious: unified reach and measurement across retail, video and audio. The trade-off? More dependence on Amazon’s data and buying infrastructure.

This deal exposes a new kind of power dynamic, where even giants are choosing collaboration over isolation to secure ad budgets. It also raises the stakes: if major players like Spotify are willing to let competitors sit between them and advertisers, the definition of platform control is changing.

We see this as the start of a consolidation era - not where one retailer wins, but where the biggest ecosystems start absorbing each other’s audiences under shared data frameworks. The question for brands is whether this “easy reach” comes at the cost of long-term independence.

Find out more here.

3. Marks & Spencer Joins TikTok Shop: A Heritage Brand Tests the Social-Commerce Waters

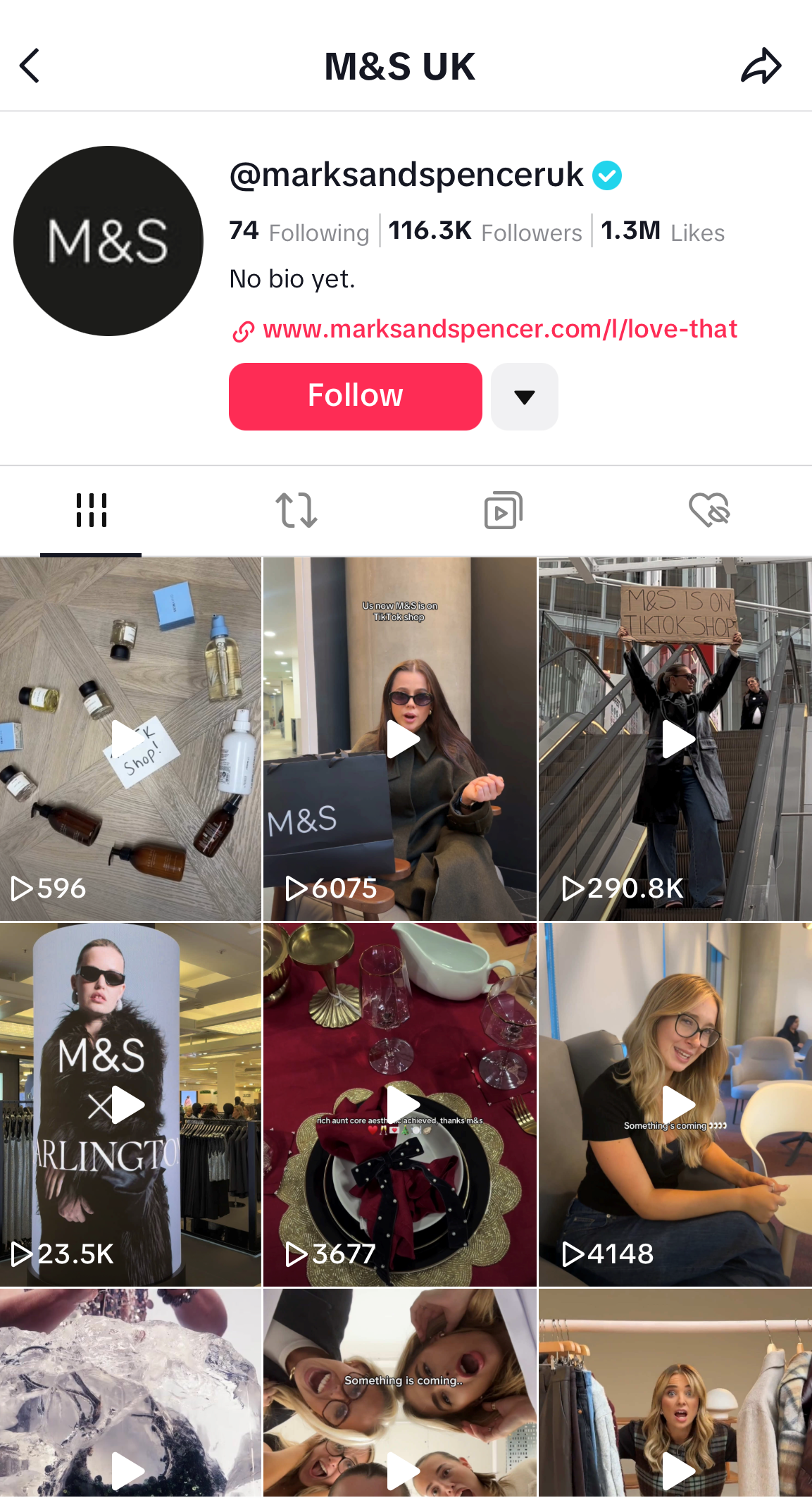

Marks & Spencer has officially launched on TikTok Shop, a bold move for a heritage retailer long associated with trusted, high-street authority rather than fast-paced social commerce. The pilot begins with a curated beauty and home-fragrance range, blending shoppable video, creator-led livestreams and exclusive bundles targeted at younger audiences.

TikTok Shop sells a beauty item every second in the UK, and M&S is tapping this momentum with affordable, giftable products such as its Apothecary range and Skinkind skincare line.

The retailer is using creator-driven storytelling - tutorials, product demos, and curated edits - to merge discovery and purchase in a single flow.

M&S’s launch contrasts with many UK retailers still hesitant to join TikTok Shop due to margin pressures, operational complexity and data-sharing concerns.

The move aligns with M&S’s “social-first, product-led” digital strategy, designed to meet new audiences where inspiration strikes.

For a brand steeped in heritage, this is less about chasing virality and more about testing the future of distribution. TikTok Shop demands a fundamentally different operating model - one where conversion happens mid-scroll, not mid-aisle. M&S’s entry signals growing confidence that social commerce can deliver more than top-funnel buzz.

It’s a calculated risk. By stepping onto a platform still refining its retail infrastructure, M&S hands over a degree of customer data and experience control. But in return, it gains access to one of the most culturally charged marketplaces in the world - a space where content, community, and commerce collide in real time.

Coming off the back of its post-cyberattack recovery and solid profit rebound, this feels less like an experiment born of desperation and more like a statement of intent. While others remain cautious, M&S is using its regained momentum to move first - and in social commerce, first movers don’t just learn faster; they define how premium brands play in creator-led ecosystems.

Find out more here.

4. Walmart & OpenAI: Chat-Driven Commerce Gets Real

Walmart has announced a partnership with OpenAI that allows customers to shop directly through ChatGPT using the new “Instant Checkout” feature. The move transforms the act of shopping from a search-and-click process into a conversational exchange - “chat → plan → pay” - positioning Walmart at the forefront of AI-driven commerce.

Shoppers can describe their needs (“family taco night” or “holiday meal for six”), receive curated product recommendations from Walmart’s catalogue, and check out seamlessly within the ChatGPT interface.

The initiative forms part of Walmart’s broader “AI-first” strategy, embedding generative AI across supply chain, merchandising, and customer service.

OpenAI’s Instant Checkout has been trialled with platforms like Shopify and Etsy, but Walmart’s adoption marks its most significant move into mainstream retail.

Industry observers note this could signal the dawn of agentic shopping - where AI systems not only respond to intent, but proactively anticipate and fulfil needs across platforms.

Walmart’s partnership with OpenAI isn’t just another experiment in conversational shopping, it’s an early blueprint for how retail media could operate in an agentic ecosystem.

As AI agents begin to interpret intent and make purchase decisions on behalf of consumers, the battleground for influence shifts dramatically. Search rankings and sponsored placements give way to recommendation rights - the privilege of being suggested by an AI that already “knows” the shopper.

This move also hints at a redefinition of retail discovery: Walmart’s product catalogue effectively becomes an API that plugs into multiple conversational ecosystems, not just its owned channels. That’s a strategic leap — one that could give Walmart presence in every interface where a shopping intent is expressed, whether or not it owns the platform.

The next wave of retail competition won’t be about who has the best website, but who their AI speaks to, learns from, and recommends first.

Find out more here.

November’s stories have one thing in common – retailer’s increasing need for rapid retail media innovation and thinking outside their current ‘lanes’.

Tesco is making creativity programmable, not procedural. Amazon and Spotify are showing that collaboration can be more valuable than competition. M&S is using cultural relevance as a growth channel, not a marketing add-on. And Walmart’s experiment with ChatGPT suggests shopping may soon be something we say, not something we click.

Retail media is maturing in unexpected ways, less about owning space, more about shaping momentum. The most interesting developments now aren’t the biggest, but the ones that quietly redefine how the ecosystem thinks and moves.