Retail Media Radar - January 2026: Structure, data and stores

January often exposes how priorities are actually shifting. Budgets reset, pilots are reviewed, and organisations start making decisions that say more about confidence than ambition.

This month, many of those signals surfaced at NRF, the National Retail Federation’s annual conference in New York, which remains the largest global gathering of senior retail leaders and technology providers. Across the event, retailers spent less time talking about new formats and more time discussing how retail media, data and technology are being built into the fabric of the business. The focus was on systems, execution and evidence rather than experimentation.

Alongside NRF, we’ve seen agency structures tighten, investment flow into measurement infrastructure, renewed focus on physical retail environments, and growing attention on how decisions are increasingly mediated through systems rather than screens. A few of those moments are worth spending some time on.

1. Agentic AI: when systems start making decisions

Another theme that cut through NRF was the growing role of bots and agentic systems in shopping journeys, with retailers discussing real-world deployment rather than future experimentation.

Systems are increasingly mediating discovery, decision-making and fulfilment on behalf of shoppers, particularly in repeat and mission-led categories.

Recent announcements from Walmart and Google reinforced this direction, outlining integrations that embed agentic AI directly into ecommerce experiences and allow systems to surface products, manage tasks and guide decisions based on intent rather than explicit instruction.

As interactions become more automated and conversational, relevance is judged earlier and more quietly, shifting influence closer to moments of intent.

Media that relies on late-stage visibility or broad exposure risks being bypassed by systems optimising for efficiency, utility and relevance.

Two new technical terms started to be more commonly discuss too in the world of agentic AI: MCP and UCP.

MCP – Model Context Protocol

A standard way for AI agents to securely access tools, data, and services (APIs, databases, actions).

Focuses on how agents connect and act reliably, not what industry they’re used in.

Think of it as the plumbing layer that lets AI agents do real things, not just talk.

UCP – Universal Commerce Protocol

A commerce-specific standard that lets AI agents discover products, manage carts, apply offers, and transact across retailers.

Designed to remove bespoke integrations between AI platforms and merchant systems.

Think of it as MCP applied to shopping and checkout.

But what’s notable here is not the technology itself, but the direction of travel. As decision-making becomes increasingly system-mediated, retail media has to operate within those flows rather than around them. Influence moves closer to intent, and execution becomes more tightly bound to real behaviour rather than exposure. The challenge now is ensuring media strategies are designed for that reality, not for interfaces that are quietly disappearing.

Find out more here.

2. Costco: infrastructure over inventory

One of the clearest signals at NRF came from Costco, which revealed the full retail media technology stack underpinning its approach.

Rather than showcasing new formats or monetisation tactics, Costco focused on infrastructure: identity resolution, clean data integration, measurement and tight alignment with merchandising outcomes.

The emphasis was on systems that support discipline and governance, not on accelerating inventory growth or expanding media surfaces.

This level of infrastructure makes clear how much underlying capability is required to support credible retail media at scale, particularly when outcomes are judged commercially rather than through media metrics.

The technology exists to reinforce restraint, enabling retail media to operate as part of merchandising and trading rather than as a standalone revenue engine.

What this reframes is the definition of maturity. Retail media here is embedded within the commercial fabric of the business, not positioned as a bolt-on opportunity to extract value. For retailers navigating similar questions, the implication is uncomfortable but clear: serious retail media capability demands sustained investment in foundations before returns can be expected. There are fewer shortcuts than the market sometimes implies.

Find out more here.

3. Costco’s alternative retail media model

Costco’s NRF announcement also sits within a broader operating philosophy that runs counter to how many retail media networks are currently being built. Rather than treating retail media as a standalone revenue stream, Costco has embedded it directly into its merchandising model, with implications for ownership, measurement and long-term value creation.

Retail media at Costco sits within merchandising rather than as a standalone media or revenue function, with teams focused on category outcomes rather than media yield.

Any revenue generated is directed back into merchandising or member value rather than treated as a high-margin profit line in its own right.

Opportunities that could generate advertising revenue are assessed against their impact on member trust and shopping experience, with some deliberately deprioritised despite commercial upside.

Costco’s advantage lies in its data foundation: 100% of transactions are member-identified, enabling robust measurement of real sales outcomes without needing to aggressively monetise attention.

This isn’t a blueprint for every retailer. Costco’s membership model, scale and margin structure are unusual. What makes it interesting is the discipline it applies to retail media’s purpose. Media exists to support merchandising and long-term value, not to optimise revenue extraction in isolation. As measurement scrutiny increases across the market, this approach sharpens a question many networks will need to answer more explicitly: what is retail media optimising for, and how is success defined?

Find out more here.

4. Agency structure follows retail media economics

Those same pressures are starting to reshape how agencies organise around retail media. Retail media doesn’t behave like other channels, and those differences are becoming harder for agency models to absorb. Revenue is retailer-specific, execution is operationally heavy, and success is judged against sales and margin rather than media metrics. Performance depends on how closely media activity aligns with merchandising, availability and trade, placing strain on agency models built around channel planning and abstracted delivery.

As retail media budgets have grown, that friction has become harder to ignore. Fragmented ownership leads to duplicated strategy, misaligned incentives and blurred accountability, particularly when performance underdelivers. The question agencies are now being forced to answer is not where retail media sits organisationally, but how it can be delivered in a way that reflects how value is actually created and measured.

It’s in this context that Omnicom’s recent move is instructive. Omnicom owns agency networks across media, creative, commerce and technology. TPN is its global shopper marketing agency, while Flywheel operates as a dedicated commerce and retail media execution engine across multiple retailers. Folding TPN fully into Flywheel aligns shopper strategy with the operational reality of retail media delivery, rather than treating it as a specialist layer alongside traditional planning and activation.

Retail media cuts across planning, activation, ecommerce operations, data and retailer relationships. As budgets have scaled, this complexity has become harder to manage within fragmented agency structures built for a different era.

Distributed ownership has led to duplicated strategy, competing incentives and blurred accountability, particularly when outcomes fall short and responsibility is unclear.

Consolidation brings retail media closer to commercial decision-making, including how investment shifts between retailers, how media interacts with trade and promotion, and how success is judged against sales and margin rather than channel metrics.

The weighting placed on operational capability is telling. Retailer fluency, SKU-level execution and the mechanics of how media, content and availability interact increasingly shape planning decisions upstream.

This mirrors what we see consistently on the brand side. Retail media works best when it is governed centrally, with clear ownership and commercial accountability, rather than distributed across specialist teams each optimising for their own lens. Where ownership is fragmented, performance tends to follow the same pattern.

Find out more here.

5. Clean rooms and the pressure for evidence

As retail media becomes more operationally embedded, the way its impact is evidenced comes under sharper scrutiny. The launch of Instacart’s Data Hub reflects growing pressure around measurement credibility as retail media is pulled closer to core commercial decision-making, rather than enthusiasm for new tooling.

Retail media investment has scaled quickly, but confidence in its ability to demonstrate incremental impact has lagged, particularly in categories where media, promotion and availability are tightly intertwined.

Clean-room environments allow advertiser data to be analysed alongside retailer purchase signals in a way that remains compliant while still being commercially useful, enabling more robust interrogation of overlap, frequency, incrementality and longer-term effects.

The availability of structured data collaboration changes expectations. Once one retailer offers privacy-safe access to purchase insight, the absence of that capability elsewhere becomes increasingly visible.

Measurement conversations are already shifting away from proxy metrics towards purchase behaviour, repeat rates and customer value, raising the bar for both retailers and brands.

That pressure isn’t confined to retail media networks. PayPal’s recent launch of transaction-graph measurement reflects the same underlying demand from brands: credible, deterministic evidence anchored in real purchase behaviour. By stitching together authenticated transactions across merchants, PayPal is responding to the same scrutiny retail media faces, even though it sits outside the RMN ecosystem.

The significance here is visibility. As measurement becomes more purchase-led and less proxy-driven, strong strategies are easier to validate and weak assumptions surface faster. The data itself doesn’t create insight; it shortens the distance between assumption and reality. That dynamic sharpens planning discipline, but it also exposes where retail media strategies lack rigour.

Find out more here.

6. In-store screens and the economics behind them

Retailers including Kroger and CVS are expanding in-store digital screen networks across their estates this year, moving well beyond trial deployments. This focus was reinforced at NRF, where physical retail was repeatedly positioned as a high-intent media environment when screens are deployed with clear behavioural context.

Ecommerce media inventory is increasingly dense, making incremental gains harder to achieve without degrading user experience or overwhelming shoppers with sponsored placements.

Physical stores remain high-intent environments, particularly in categories where choice is made in front of the shelf, offering long dwell times and clear proximity to purchase.

Screens monetise attention that already exists, generating media revenue without adding friction to digital journeys and without relying on additional traffic acquisition.

Advances in content management, programmatic control and store-level data integration make large-scale deployments more operationally viable than they were even a few years ago.

Outcomes here depend entirely on execution. Research shared at NRF showed consistent sales uplift over multiple years when digital signage was aligned to store flow, category behaviour and shopper missions. Screen strategies that ignore these factors risk becoming visual noise very quickly. Those designed as part of the wider retail system can influence choice at precisely the point where decisions are made.

Find out more here.

7. RCS and the shift towards intent-led retail interaction

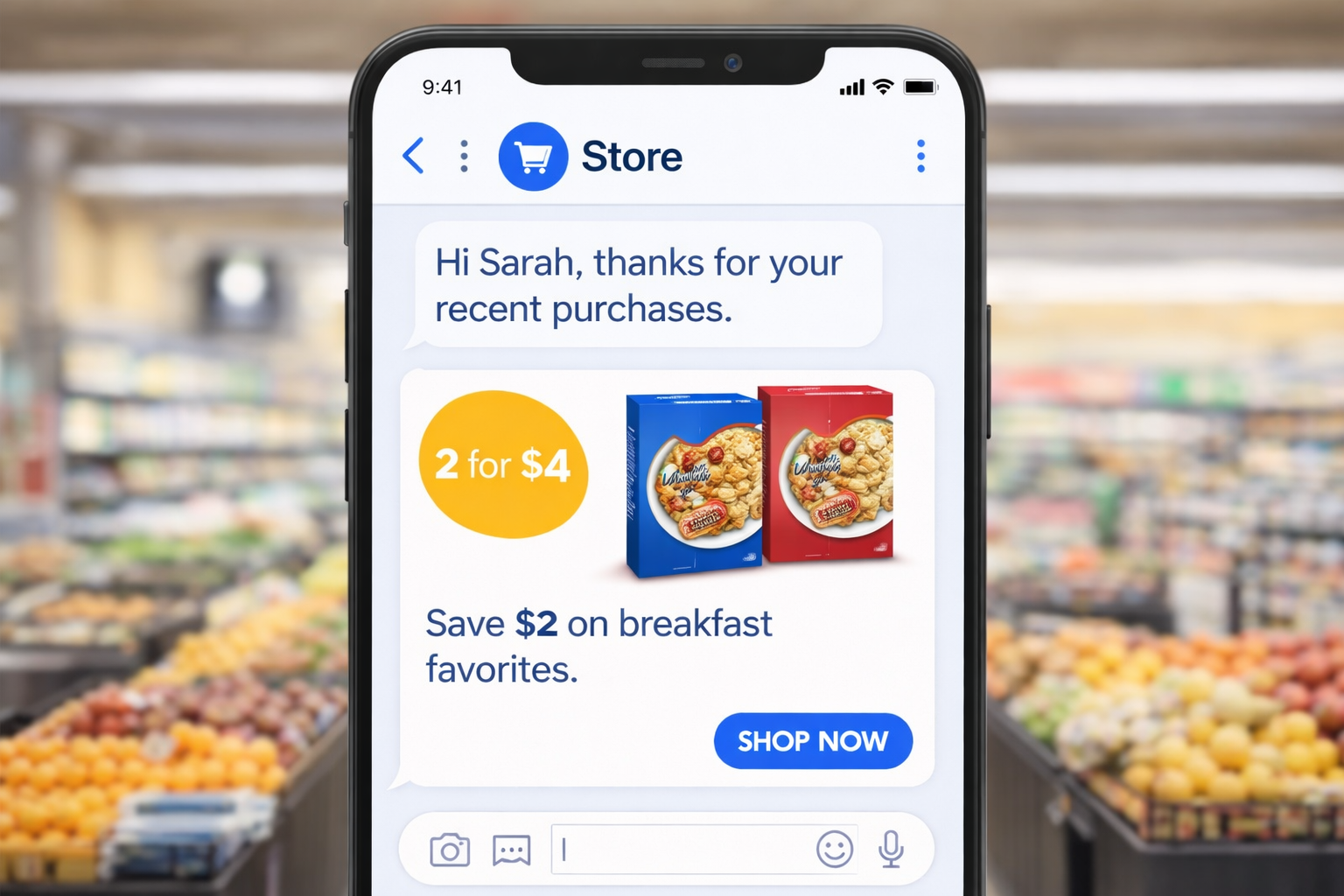

A recent piece from InternetRetailing highlights how Rich Communication Services (RCS) is being positioned as a retail media channel in its own right, particularly as retailers look to apply influence closer to moments of intent rather than relying on broader media exposure.

RCS enables rich, app-like messages to be delivered directly into a shopper’s native messaging inbox, combining imagery, product information, offers and calls to action within a one-to-one environment.

Unlike traditional retail media formats, RCS operates within an authenticated, personal channel, allowing messages to be triggered by behaviour, context and intent rather than broad audience segments.

The format blurs the line between media, CRM and service, supporting interactions such as product reminders, stock alerts, abandoned basket follow-ups and personalised promotions.

Measurement is inherently closer to outcome, with engagement and conversion tracked at the individual level rather than inferred through proxy metrics.

This focus on direct, timely interaction aligns with recent commentary from The Drum, which argues that retail media increasingly succeeds or fails in the first moments of exposure. As shopper attention fragments, relevance is judged almost instantly, placing greater value on channels that arrive early, feel personal and align closely with intent. In that context, formats like RCS benefit not from novelty, but from their ability to operate inside the shopper’s existing decision flow.

What makes RCS interesting is not scale, but precision. It represents retail media extending into moments where shoppers are already making decisions, rather than competing for attention elsewhere. Used well, it supports relevance and utility. Used poorly, it risks feeling intrusive. As with other developments this month, its effectiveness depends less on the technology itself and more on how deliberately it is integrated into the broader retail strategy.

Find out more here.

The thread running through this issue is not innovation for its own sake, but intent.

From the priorities surfaced at NRF to the organisational changes, infrastructure investments and operating models explored elsewhere in this issue, retail media is increasingly being shaped through decisions that sit closer to the core of the business. Where teams sit, how systems connect, and which trade-offs organisations are prepared to make are all becoming more explicit.

This marks a shift in how retail media is evaluated. Success is less about adding inventory or accelerating rollout, and more about how well media activity integrates with merchandising strategy, customer interaction and measurement that withstands scrutiny.

What stands out is the willingness to make harder, quieter choices. To invest in foundations rather than formats. To prioritise evidence over optics. And, in some cases, to say no to revenue that doesn’t align with long-term value. These decisions rarely generate headlines, but they shape how retail media performs once momentum gives way to reality.